The Covered Call Strategy

Covered calls, also called "Covered calls", are very often used by hedge funds or certain very experienced individual traders.

A covered call is an options strategy where the investor buys (or already holds) a long position in a stock or other asset and sells call options on that same asset.

Definition of a call and a put

What is a call and a put?

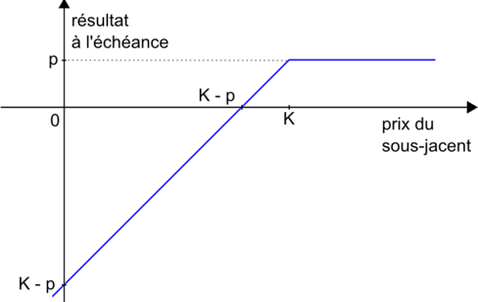

A Call represents a right to purchase the underlying asset at the strike price upon expiry of the option.

A Put represents a right to sell the underlying asset at the strike price upon expiration of the option.

The underlying represents the asset attached to the option.

A Call and a Put are in no way an obligation to buy or sell. They simply confer a right that the holder is free to exercise or not at the expiration of the option.

Example of a call and a put

At the maturity of a Call, two scenarios can occur:

- The exercise price is higher than the price of the underlying asset: the holder of the Call will then not exercise his right to purchase, because the exercise price of the option is unfavorable to him

- The exercise price is lower than the price of the underlying asset: the holder of the Call will then exercise his right to purchase because the exercise price of the option is favorable to him

At the maturity of a Put, two scenarios can occur:

- The exercise price is higher than the price of the underlying asset: the holder of the Put will then exercise his right to sell because the exercise price of the option is favorable to him

- The exercise price is lower than the price of the underlying asset: the holder of the Put will then not exercise his right to sell, because the exercise price of the option is unfavorable to him

When to buy a call or a put

Calls and Puts represent a bet on the future.

If you anticipate the underlying asset to rise, you can buy a call. The higher the price of the underlying asset rises, the more valuable your call becomes. You can sell it back at any time as long as the option's expiration date has not been reached.

If you anticipate a decline in the underlying asset, you can buy a Put. The more the underlying asset's price falls, the more valuable your Put becomes. You can sell it at any time as long as the option's expiration date has not been reached.

An individual is not allowed to short sell a call or put because the potential loss is theoretically unlimited. Only financial institutions (banks) can do this. This is why they are always your counterparty if you buy a call or put. However, you are allowed to sell a call or put if you own one.

Using Calls and Puts

Calls and puts are leveraged derivatives. They can be used for speculative or hedging purposes.

In the case of speculation, Calls and Puts allow you to benefit from significant leverage and have unlimited profit potential. In the event of an unfavorable scenario, the amount of losses is known in advance; this is the price paid for the purchase of Calls or Puts.

In the case of a hedging transaction, calls and puts prove to be very effective tools. They allow you to avoid mobilizing a significant portion of your capital to protect yourself against market risk. Options are widely used by fund managers.

NOTICE ON THE RISKS ASSOCIATED WITH THE PURCHASE OF CALL OR PUT OPTIONS

The risks associated with investing in options can be considerable. We would ask you to carefully consider whether such investments are suitable for you in light of your circumstances and financial means.

Object

The client agreement you entered into with OIS Finance, as well as the power of attorney you granted to your manager, clearly describe your options as follows:

You buy call or put options, that is, you appear as the buyer of an option and you have the obligation to resell the option, if possible, no later than the last business day that can be determined in advance.

Exercising the right of option and transforming it into a futures contract is not possible, as this type of service is not part of our services.

Aim

The buyer of a call option on futures, currencies or securities speculates on the rise in the price of the underlying contract and thus hopes for an increase in the option premium, in order to be able to resell his call option at a profit.

The buyer of a put option on futures, currencies or securities speculates on a fall in the price of the underlying contract and thus hopes for an increase in the option premium, in order to be able to resell his put option at a profit.

Definition

An option is a contract between two parties. The buyer acquires an option in exchange for payment of the option price (premium). The constituent elements of an option are:

- standardized quality (contract size)

- a specific good (product, index, currency)

- a base price (effective price of the good)

- a price determined in advance (execution price, strike)

- a deadline determined in advance for exercising the right of option (expiry)

Price determination

Intrinsic value:

The intrinsic value of a call option is the amount of the future contract price that exceeds the execution price of the option right.

For put options, this is the amount of the price of the future contracts which is below the exercise price of the option right.

Some options have no intrinsic value, while at any given time various options will have different exercise prices for the same basic value.

Value over time:

This value varies depending on the proximity of the deadline.

The value in time is greater the further away the deadline.

Costs :

The buyer of an option must take into account the costs of executing transactions when calculating the price or rate that the underlying asset must reach in order to make a profit when reselling the option.

Specific risks associated with the purchase of options

An option buyer should be aware that they can lose the entire option price if the underlying asset price does not move in the desired direction, or even if the price remains unchanged. An investor also loses part of their investment when the underlying asset price remains unchanged because the value of an option decreases over time.

It is important that every buyer of an option is aware that he or she may lose the entire price of the option.

General risks

Under certain conditions, it may be difficult or even impossible to liquidate a position, i.e., to sell an option. This may be the case, for example, when the market reaches a price limit (limitup/limitdown) when the price is moving rapidly. A stop-loss order (designed to limit losses) does not always limit losses to the expected amount, as market conditions may make it impossible to execute such orders.